Credit Risk RWA Calculator

Credit risk, the risk of loss due to a borrower being unable to repay a debt in full or in part, accounts for the bulk of most banks’ risk-taking activities and regulatory capital requirements.There are two broad approaches to calculating RWAs for credit risk: the standardised approach (STD) Under this approach, supervisors set the risk weights that banks apply to their exposures to determine RWAs. and the internal ratings based approach (IRB). Under this approach Banks use their internal models to calculate risk-weighted assets.There are two main IRB approaches: Foundation IRB (F-IRB) and Advanced IRB (A-IRB).Source:BIS.org

| Capital_req (K) | Correlation Factor (r) | RW (Post Scaling Factor 1.06) | RWA | Maturity Adj |

|---|---|---|---|---|

| Basel Approach | Customer Type | Firm Size | PD | LGD |

| Residual Maturity (K_Mat) | Exposure Class | AVC | EAD | BEEL |

| Approach | Exposure Class | Origin Country | ECA Risk Score Country risk classification |

External Rating | Risk Weight | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

Risk Weights under Standardised approach ,based on ECAIs (External Credit Assessment Institutions ) mapping of credit assesments to credit quality step ( CQS ) .

This is recognised under the Capital Requirements Regulations 2006 (SI 2006/3221) for the purposes of BIPRU 3 The Standardised Approach

Long term mapping

| CQS | DBRS rating | S&P Rating | Moodys Rating | Fitch Rating | Sovereign | Corporate | PSE (soverign method) | Institutions ( unrated /Sovereign method) | Institutions ( rated & residual maturity > 3 months) | Institutions ( rated & residual maturity 3 months or less) |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | AAA to AAL | AAA to AA- | Aaa to Aa3 | AAA to AA- | 0% | 20% | 20% | 20% | 20% | 20% |

| 2 | AH to AL | A+ to A- | A1 to A3 | A+ to A- | 20% | 50% | 50% | 50% | 50% | 20% |

| 3 | BBBH to BBBL | BBB+ to BBB- | Baa1 to Baa3 | BBB+ to BBB- | 50% | 100% | 100% | 100% | 100% | 20% |

| 4 | BBH to BBL | BB+ to BB | Ba1 to Ba3 | BB+ to BB- | 100% | 100% | 100% | 100% | 100% | 50% |

| 5 | BH to BL | B+ to B- | B1 to B3 | B+ to B- | 100% | 150% | 100% | 100% | 100% | 50% |

| 6 | CCCH and below | CCC+ and below | Caa1 and below | CCC+ and below | 150% | 150% | 150% | 150% | 150% | 150% |

-

** PSE (Sovereign method) : For unrated PSE , use Sovereign's CQS to arrive at Risk Weight

-

** Unrated Institution : For unrated Institution , use Sovereign's CQS to arrive at Risk Weight

Short-term mapping

| CQS | DBRS rating | S&P Rating | Moodys Rating | Fitch Rating | Risk Weight |

|---|---|---|---|---|---|

| 1 | R-1 (high), R-1 (middle), R-1 (low) | A-1+, A-1 | P-1 | F1+, F1 | 20% |

| 2 | R-2 (high), R-2 (middle), R-2 (low) | A-2 | P-2 | F2 | 50% |

| 3 | R3 | A-3 | P-3 | F3 | 100% |

| 4 | R-4, R-5 | B-1, B-2, B-3, C | NP | Below F3 | 150% |

Collective investment undertakings (CIUs)

| CQS | S&P Rating | Moodys Rating | Fitch Rating | Risk Weight |

|---|---|---|---|---|

| 1 | AAAf to AA-f | Aaa to Aa3 | AAA to AA- | 20% |

| 2 | A+f to A-f | A1 to A3 | A+ to A- | 50% |

| 3 | BBB+f to BBB-f | Baa1 to Baa3 | BBB+ to BBB- | 100% |

| 4 | BB+f to BB-f | Ba1 to Ba3 | BB+ to BB- | 100% |

| 5 | B+f to B-f | B1 to B3 | B+ to B- | 150% |

| 6 | CCC+f and below | Caa1 and below | CCC+ and below | 150% |

x

| Exposure to Banks | |||||||

|---|---|---|---|---|---|---|---|

| Risk weights in jurisdictions where the ratings approach is permitted | |||||||

| External rating | AAA to AA– | A+ to A– | BBB+ to BBB– | BB+ to B– | Below B– | Unrated | |

| Risk weight | 20% | 30% | 50% | 100% | 150% | As per SCRA Grades | |

| Short-term exposures | |||||||

| Risk weight | 20% | 20% | 20% | 50% | 150% | As per SCRA Grades | |

| Risk weights where the ratings approach is not permitted and for unrated exposures | |||||||

| SCRA Grade Based (Standardised Credit Risk Assessment Approach) | Grade A | Grade B | Grade C | ||||

| Risk weight | 40%* | 75% | 150% | ||||

| Short-term exposures | 20% | 50% | 150% | ||||

|

* A risk weight of 30% may be applied if the exposure to the bank satisfies all of the criteria for Grade A classification and in addition the counterparty bank has (i) a CET1 ratio of 14% or above; and (ii) a Tier 1 leverage ratio of 5% or above |

|||||||

x

| Exposure to Covered Bonds | |||||||

|---|---|---|---|---|---|---|---|

| Risk weights for rated covered bonds | |||||||

| External issue-specific rating | AAA to AA– | A+ to BBB– | BB+ to B– | Below B– Below B– | |||

| Risk weight | 10% | 20% | 50% | 100% | |||

| Risk weights for unrated covered bonds | |||||||

| Risk weight of issuing bank | 20% | 30% | 40% | 50% | 75% | 100% | 150% |

| Risk weight | 10% | 15% | 20% | 25% | 35% | 50% | 100% |

x

| Exposure to Corporates | |||||||

|---|---|---|---|---|---|---|---|

| Risk weights in jurisdictions where the ratings approach is permitted | |||||||

| External rating of counterparty | AAA to AA– | A+ to A– | BBB+ to BBB– | BB+ to BB- | Below BB- | Unrated | |

| Risk weight | 20% | 50% | 75% | 100% | 150% | 100% or 85% if corporate SME | |

| Risk weights where rating approach is not permitted | |||||||

| SCRA Grade Based (Standardised Credit Risk Assessment Approach) | Investment grade | All other | |||||

| General corporate (non-SME) | 65%* | 100% | |||||

| SME general corporate | 85% | ||||||

x

| Retail Exposures (excluding real estate) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Regulatory retail (non-revolving) | Regulatory retail (revolving) | Other retail | |||||||

| Transactors | Revolvers | ||||||||

| Risk weight | 75% | 45% | 75% | 100% | |||||

x

| Specialised Lending Exposure (Project Finance,Object Finance and Commodities Finance) | |||||||

|---|---|---|---|---|---|---|---|

| Exposure (excluding real estate) | Project finance | Object and commodity finance | |||||

| Issue-specific ratings available and permitted | Same as for general corporate (see STD Corporates) | ||||||

| Rating not available or not permitted |

|

100% | |||||

x

| Retail :Residential Real Estate exposures | ||||||||

|---|---|---|---|---|---|---|---|---|

| LTV bands | Below 50% | 50% to 60% | 60% to 70% | 70% to 80% | 80% to 90% | 90% to 100% | Above 100% | Criteria Not Met |

| General RRE | ||||||||

| Whole loan approach RW | 20% | 25% | 30% | 40% | 50% | 70% | RW of counterparty | |

| Loan-splitting approach** RW | 20% | RW fo Counterparty | ||||||

| Income-producing residential real estate (IPRRE) | ||||||||

| Whole loan approach RW | 30% | 35% | 45% | 60% | 75% | 105% | 150% | |

|

** Under the loan-splitting approach, a supervisory specified risk weight is applied to the portion of the exposure that is below 55% of the property value and the risk weight of the counterparty is applied to the remainder of the exposure. In cases where the criteria are not met, the risk weight of the counterparty is applied to the entire exposure |

||||||||

x

| Commercial real estate (CRE) exposures | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| General CRE | |||||||||

| Whole loan approach | LTV ≤ 60% | LTV > 60% | Criteria not met | ||||||

| Min (60%, RW of counterparty) | RW of counterparty | RW of counterparty | |||||||

| Loan-splitting approach** | LTV ≤ 55% | LTV > 55% | Criteria not met | ||||||

| Min (60%, RW of counterparty) | RW of counterparty | RW of counterparty | |||||||

| Income-producing commercial real estate (IPCRE) | |||||||||

| Whole loan approach | LTV ≤ 60% | 60% < LTV ≤ 80% | LTV > 80% | Criteria not met | |||||

| 70% | 90% | 110% | 150% | ||||||

| Land acquisition, development and construction (ADC) exposures | |||||||||

| Loan to company/SPV | 150% | ||||||||

| Residential ADC loan | 100% | ||||||||

|

** Under the loan-splitting approach, a supervisory specified risk weight is applied to the portion of the exposure that is below 55% of the property value and the risk weight of the counterparty is applied to the remainder of the exposure. In cases where the criteria are not met, the risk weight of the counterparty is applied to the entire exposure |

|||||||||

x

| Subordinated debt and equity (excluding amounts deducted) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Subordinated debt and capital other than equities | Equity exposures to certain legislated programmes | Speculative unlisted equity | All other equity exposures | |||||

| Risk weight | 150% | 100% | 400% | 250% | ||||

x

| Credit conversion factors for off-balance sheet exposures | ||||||||

|---|---|---|---|---|---|---|---|---|

| UCCs | Commitments, except UCCs | NIFs and RUFs, and certain transactionrelated contingent items | ST self-liquidating trade letters of credit arising from the movement of goods | Direct credit substitutes and other off balance sheet exposures | ||||

| CCF | 10% | 40% | 50% | 20% | 100% | |||

x

| Corporate Exposures under IRB Approach | ||||||||

|---|---|---|---|---|---|---|---|---|

| Probability of default (PD) | Loss-given-default (LGD) | Exposure at default (EAD) | ||||||

| Unsecured | Secured | |||||||

| Corporate | 5 bp * | 25% |

|

EAD subject to a floor that is the sum of (i) the onbalance sheet exposures; and (ii) 50% of the offbalance sheet exposure using the applicable Credit Conversion Factor (CCF) in the standardised approach |

||||

|

* 1bp or basis point = 1/100 of 1% or .01% or 0.0001 . 5bp = .0005 |

||||||||

x

| Retail Exposures under IRB Approach | ||||||||

|---|---|---|---|---|---|---|---|---|

| Retail Exposure Class | Probability of default (PD) | Loss-given-default (LGD) | Exposure at default (EAD) | |||||

| Unsecured | Secured | |||||||

| Mortgages | 5bp * | N/A | 5% | EAD subject to a floor that is the sum of

(i) the onbalance sheet exposures; and (ii) 50% of the offbalance sheet exposure using the applicable Credit Conversion Factor (CCF) in the standardised approach |

||||

| QRRE Transactors | 5bp * | 50% | N/A | |||||

| QRRE Revolvers | 10 bp * | 50% | N/A | |||||

| Other Retail | 5bp * | 30% |

|

|||||

|

* 1bp or basis point = 1/100 of 1% or .01% or 0.0001 . 5bp = .0005 10bp = .01% or 0.001 |

||||||||

*** Errors and Omissions Disclaimer

The information given by the RWA Calculator is for general guidance on matters

of interest only. Even if the Company ( techranger.com ) takes every precaution to insure that the

calculation is both current and accurate, errors can occur.

Plus, given the changing nature of

laws, rules and regulations, there may be omissions or inaccuracies in the information contained on the

Caculator.The Company is not responsible for any errors or omissions, or for the results obtained from

the use of this information.

Risk Parameter Impact Assessment

K = max(0,LGD-BEEL)

RWA = K *12.5 * EAD

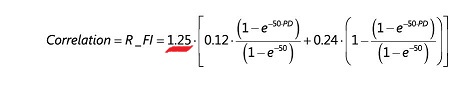

Regulated financial institutions whose total assets are greater than or equal to US $100 billion.A regulated financial institution is defined as a parent and its subsidiaries where any substantial legal entity in the consolidated group is supervised by a regulator and its asset size is determined using the most recent audited financial statement.

Unregulated financial institutions, regardless of size. Unregulated financial institutions are, for the purposes of this paragraph, legal entities whose main business includes: the management of financial assets, lending, factoring,leasing, provision of credit enhancements, securitisation, investments,financial custody, central counterparty services, proprietary trading and other financial services activities identified by supervisors.

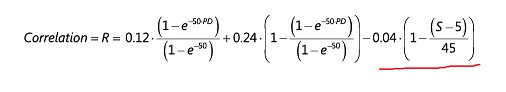

A firm-size adjustment (ie 0.04 x (1 – (S – 5) / 45)) is made to the corporate risk weight formula for exposures to SME borrowers. S is expressed as total annual sales in millions of euros with values of S falling in the range of equal to or less than €50 million or greater than or equal to €5 million. Reported sales of less than €5 million will be treated as if they were equivalent to €5 million for the purposes of the firm-size adjustment for SME borrowers.

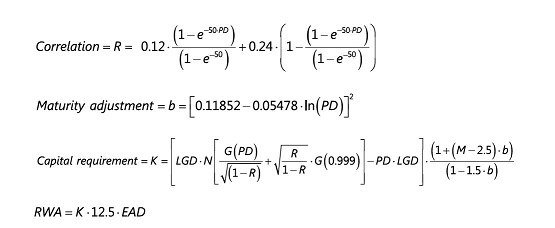

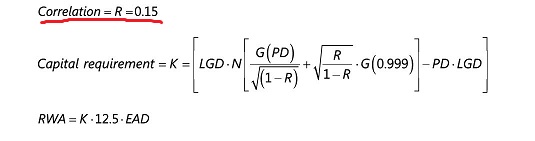

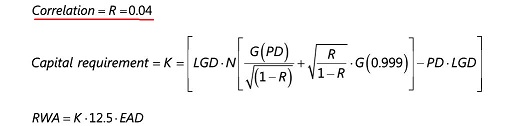

Retail residential mortgage (RRE) exposures that are not in default and are secured or partly secured by residential mortgages, risk weights will be assigned based on the following formula:

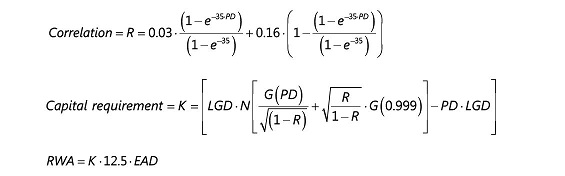

Qualifying revolving retail exposures (QRRE) exposures that are not in default , risk weights will be assigned based on the following formula:

Other retail exposures exposures that are not in default, risk weights are assigned based on the following function, which allows correlation to vary with PD:

The Basel Committee on Banking Supervision (BCBS)

Basel III: international regulatory framework for banks

REUTERS : Explainer

What is the 'Basel III endgame' and why are banks worked up about it?

Council of the EU : Press release

Banking sector: Provisional agreement reached on the implementation of Basel III reforms

Investopedia

How Will New Capital Requirement Rules Ensure Bank Stability?

The European Banking Authority (EBA)

Implementing Basel III in Europe

The Federal Deposit Insurance Corporation (FDIC)

An Update on Emerging Issues in Banking

The Reserve Bank of India

Master Circular – Basel III Capital Regulations